Why Stripe Is Expensive For Small Business in Ireland

Over a decade ago, I was pretty early to be writing about Stripe pricing - the now world-beating payments processor that have made billionaires out of the Collison brothers (much deservedly too).

For 2024, I'm looking back at my previousl posts, adding fresh insights as well as publshing all-new content in the weeks and months ahead. So how does this post hold up all these years later?

Well, my key insight is as true today as it was then. Back then I was using Paymentsense for my card processing and the deal I was on was a higher % commission but there was 0c flat fee on visa debit cards. I don't know if they are still running price plans like this - I somehow doubt it. And ultimately it wasn't enough for me to avoid going over to Shopify Payments (powered by Stripe I believe) but there's no doubt my overall card processing fees went through the roof compared to what I was paying Payment Sense.

Should The EU Look at Card Processing Fees From an Anti-Trust (Competition) Perspective?

Yes, I think this may happen. If you look at the way the EU is now challenging big tech on issues like app store access and abuse of dominant position and if you also look at how companies like Meta are being forced to change the way they offer their products in the EU, I have a feeling card processing might be in their cross hairs at some point.

Big platforms like Shopify make it pretty difficult to take card payments on their platform outside their own service (Shopify payments). If you want to use a 3rd party gateway, you'll pay more per transaction and incur higher development fees. At some point, this might be challenged in the courts here in the EU.

This is not an issue for Stripe of course but it's a subject that interests me generally and what I've found is that card processing fees are generally very opaque and it can be hard to compare different plans from competing processors.

Strip was supposed to be the disruptor in this space but I'm not so sure that's the case anymore. They've become one of the dominant players, like Shopify have in the small enterprise space online.

Here's my original post, with a refresh here and there for good measure.

Stripe is on a serious roll at the moment and looks set to be a major rival to the big players in the payments industry such as Paypal. Anyone who is familiar with the story of the Collison brothers from Limerick will wish the company well - it's a great success story for Irish entrepreneurship and tech talent. In fact as we see it, Stripe is disrupting not only the big incumbents in the field - but the entire landscape of online payments - with it's complicated and convoluted structure of payment gateways and merchant service providers. With just a few lines of code, Stripe does away with the need for both - it's a genuinely innovative piece of technology that strips out all the complexity of setting up an e-commerce business as far as taking payment goes.

Stripe on Shopify

So when we decided to move to Shopify, I was pretty keen to take a look at Stripe Ireland to see how it measured up against the other options for a small Irish online business like ours. Shopify integrates seamlessly with Stripe (and Bitcoin) so the temptation to join the revolution and sign up with Stripe was obvious. Until I started to crunch the numbers that is.

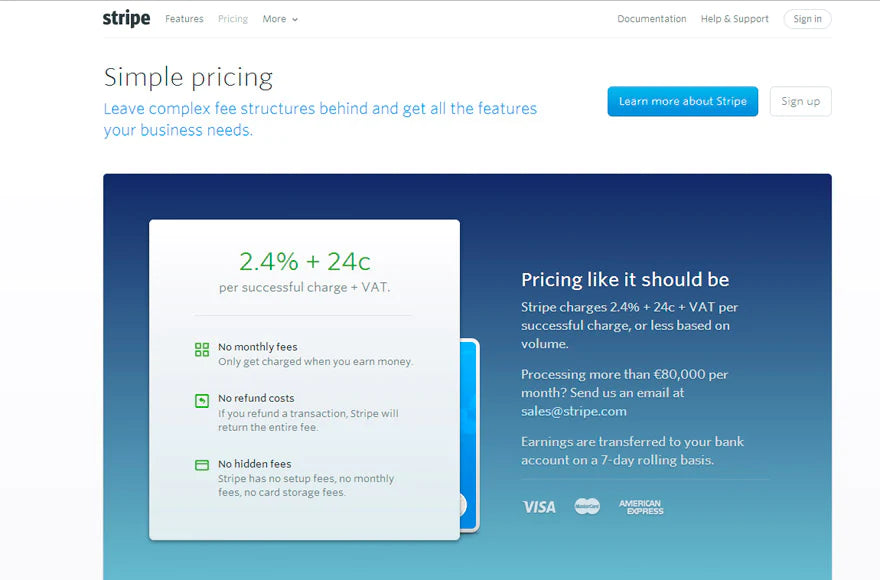

As far as I can see, Stripe in Ireland just doesn't stack up financially. It's pitched at 2.4% + 24c per transaction and they make a very big play out of the fact that there are no hidden extras, no confusing exception charges, monthly recurring charges etc. That's all well and good but 2.4% + 24c is still high and here's the killer for me anyway - that's charged on every type of card - even VISA DEBIT.

Now, in Ireland the VISA DEBIT is fairly new - it's the replacement for the old Laser scheme operated by the Irish banks. And crucially, those transactions generally do not attract a percentage fee at all - they usually go through at 20 to 25 cents only. Adoption of visa debit is very high in Ireland and we certainly see a lot of transactions on this card rather than a credit card. In fact, through the recession in Ireland the trend was not only for people to pay down unsecured debt like credit card borrowings, but also to avoid using them at all. So use of this card is high. As soon as we started to look at the numbers in detail, Stripe Ireland had serious disadvantages over their more traditional competition.

Even allowing for the extra cost of using a payment gateway like Realex or Payment Sense, Stripe Ireland was still more expensive. I reached out to Stripe a couple of times in the course of my research but they never actually addressed this issue with me. In the end, we decided to go with Payment Sense who offered us a much more attractive deal. The acid test will be if our actual bills reflect the headline rates or whether the opaque nature of the terms disguise some hidden charges that we hadn't taken account of. I'm not convinced that will be the case but we'll watch how things unfold and will revisit this in the future.

For the moment though, we wish Stripe continued success in Ireland and worldwide but we're passing right now.

Additonal Notes in 2024

The other relevant point today is about PCI compliance. I was with Payment Sense when this came in at the start and it was a total nightmare on their platform. Shopify and Stripe in contrast had PCI compliance baked in and it was neve an issue. In the end, for small business, it's not just the cost in euros and cents - it's precious time as well and I was not prepared to spend hours every few months jumping through endless PCI compliance hoops with Payment Sense.